Scientific electronic library of monographs, seen from the Russian Academy of Natural History. The structure of the capital of the enterprise

The structure of capital is the sum of the financial assets of the enterprise from the various branches of the long-term finance, or, to be more precise, the spiving of short-term goiter, long-term goiter and the state capital of the organization.

Capital structure. Hot meals

If the business is expanding, then the necessary capital, depending on the way the business is dividing up, is the capital that is in your power. Pozikovі koshti mayut dvі іstotnі perevagi. In a first way, the ones that are crying, are seen when the tax is paid, which lowers the actual quality of the posture. In a different way, those who give a position, fix the income, and the shareholders are not guilty of sharing income with them, so that the business will be successful.

However, the positional cats have some shortfalls. In the first place, what is the cost of the cost factor, then the enterprise is risky, and then, more versatility for the company and the positional capital, and the power capital. In another way, as the company is going through, the hardship of that її operating profit does not get to cover the cost of paying the rent, the shareholders themselves will be responsible for the deficit, and if the stench is not possible, the company will be deafened by a bankrupt.

Therefore, undertakings, yakі mayut surpluses and operational flows of non-stable capital, are responsible for interfacing the salary of the positional capital. On the other side, those subsidiaries, who have stable cash flows, can more easily get better finance. However, there is a question: what is the best financing for the “wealth”? Like “so”, why can firms finance themselves more for the money of the poor ones, why do they still sing the world? As for the best solutions - a combination of positional costs and power capital, then how is it optimal?

The cost of being a firm is to induce the values of the possible free penny flows, discounting for the average cost of capital (Weighted Average Cost of Capital, WACC). Change the structure of the capital, which changes the characteristics of its components, influence the risk and variability of the skin type of the capital, as well as the WACC in the whole. Changes in the structure of capital can also be added to free penny flows, influencing the decisions of managers, linking capital deposits to the budget, as well as influencing bankruptcies, causing bankruptcy and financial collapse. Also, the structure of capital flows like a free cash flow, and to WACC, also, and share prices.

In addition, a lot of companies pay dividends, as if they change non-distributed profits, and in such a rite to increase the sum, as if the companies are guilty of knowing dodatkovo in order to secure the financing of their business. Also, the decision about the structure of capital is related to the policy of paying dividends. For this site we have decided to choose the structure of the capital.

A lot of factors are added to the decision about the structure of capital, as you say, the designation of the optimal structure of capital is not an exact science. That's why navіt firms that lie on the same and the same galusi often ruin the structure of capital, which is significantly irritated. Here we are looking back at a glance in the structure of the capital risk and its components, after which we have chosen the optimal balance of position and power.

Optimization of the capital structure

The activity of acceptance is subordered by the singing life cycles. To assess the structure of the government's capital of business, and to make a decision about optimization, it is necessary to understand what stage of development the company is going through at any given time.

The most dynamic stage of development and diversification of business, if it is possible to make a decision about investments and zherel. Take away from the source of nutrition, from which dzherel vigidnіshe zdіysnіt іnvestitsії, to support the method and financial modeling.

In practice, the situation is most likely to develop, if the lack of credit resources allows the short term to achieve an economic effect, then the accumulation of profit for projects is a process, and an hour, apparently, is a penny. It's a good time to save up to more swedish rostan undertakings and maximization of income.

At the stage of stabilization, the need for pre-stroke positions can not be blamed. For tsієї stage normal є the structure of capital, de part of positional capital is minimal.

During the downturn of the crisis, plans for further activity of the company are being expanded. As a rule, at the moment anti-crisis is being discussed, come in or a decision is made about liquidation. As soon as a plan is drawn up to eliminate the company from the crisis, then at this stage profitability indicators will decrease, financial stability will decrease. In this situation, getting into the Borg and the position of the power capital to the position is even low (to tell about the crisis situation). Here, the structure of capital becomes more significant, and the trends in the change of the financial portfolio and future displays, insurance against the recovery plan from the crisis.

I would like to say that there are no universal criteria for shaping the optimal structure of capital. The transition to a leather company can be individual and protect both Galuzev's business specifics and the stage of business development. Those that are typical for the structure of the capital of the company, that specialize, for example, in the management of unruliness, which are not familiar to firms in the sphere of trade services. In these enterprises, the consumption of wealth is in the hands of the werewolves, and the wealth of funds. The next step is to protect such an official as publicity: non-public companies with a large number of shareholders (shareholders) are mobile in making a decision about winning a profit, which allows them to easily vary the size and structure of capital.

The structure of the capital depends on the investment of the positional capital and the government capital, investigating the financing of the long-term development of business. In addition, as the structure is optimized, to lay the success of the implementation of the financial strategy of the company as a whole. It is optimal for one's own land to lay down the deposit of the cold and wet capital in the form of a vartost.

The pardon has been extended to the Russian business middle, for which the capital of the power is paid free of charge. In this case, the obvious fact is forgotten: the payment for the power capital is dividends, and it is practical to raise funds for the money of the rich money of the most expensive people. For example, as a master of business, it is possible to take dividends, say, at a rate of 40%, the amount of money for capital becomes more important, and the amount of money for credits is lower.

As a show of light practice, the development of only for the financial resources of the government (by way of reinvestment of income for the company) changes the financial risks in the business, but with this, the security of the increase in the expansion of the business is greatly reduced. Navpaki, zaluchennya dodatkovogo position capital for the right financial strategy and good financial management can dramatically increase the income of the owner of the company from their capital investments. The reason is that the increase financial resources with competent management, to bring about a proportional increase in the obyagu sale and, most of all, net income. It is especially important for small and medium companies.

Prote overwhelmed by positional costs, the structure of capital presents an over-the-top high income to yogo profitability, but the shards move the non-payments and increase the risks of the investor. In addition, customers and post-heads of the company, having commemorated a high part of the low prices, can start talking about the best partners, which will bring you to the fall of the viruchka. On the other hand, a low share of the position capital means a low share of the potentially cheap, low power capital, financial support. Such a structure could lead to more high capital investment and increase in profitability of possible investments.

The optimal structure of capital is the same setting of the upper and lower necks in order to ensure optimal support between equals ..., tobto. maximizing market variability of business. For the optimization of capital, it is necessary to heal the skin part.

Power capital is characterized by such additional moments:

1. The simplicity of learning (needs the decision of the sergeant to help other sovereign subjects).

2. A high rate of income for capital investments, tk. do not pay for hundreds of koshtiv.

3. Low risk of spending financial stability and bankruptcy of the enterprise.

Nedolіki vlasnyh koshtіv:

1. Obmezheniya obsyag zaluchennya, tobto. it is impossible to expand the state's activity.

2. There is no chance of an increase in the profitability of government capital for the salary of earning cash.

In such a rank, undertaking, that victorious is less than money, I can find financial stability, but I can also increase my ability to increase profits.

Benefits of position capital:

1. Broad possibilities for obtaining capital (for obviousness, make sure you have guarantees).

2. Increasing the financial potential of the enterprise for the need to increase the obligations of the government.

3. Building increases the profitability of government capital.

Shortfalls in position capital:

1. The folding of the beam, because decision to deposit in other subjects of the state.

2. Necessity to get chi guarantees.

3. Low rate of return on assets.

4. Low financial stability of business.

Also, undertaking that victorious positional capital, there is a greater high potential and the possibility of increasing the profitability of government capital. With whom, financial stability is ruined.

For vimiryuvannya sukupnyh results, which reach with a different spіvvіdnіnіnі vіvіdnіnі vіvі and pozikovogo kapital vikoristovuyut financial display - financial levіrіdzh (FO). FD vimiryuє effect, which polagaє in increasing the profitability of the government capital for the money raising a part of the position capital in the total amount.

ETF = (Ra - PS) * SC / SC, de Ra - return on assets, PS - interest rate for a loan, SC - position capital, SC - government capital.

(Ra - PS) is called the financial leverage differential. ZK / SK - ... and characterizes the total amount of positional capital, which falls on a single share.

Viewing these warehouses allows you to manage the effect of financial leverage. As a positive differential, increase the coefficient to increase the effect. Prote zrostannya ETF may mezhu, tk. Reducing the financial stability to bring up to the increase in the rate of vіdsotka.

For the first coefficient, the differential can be reduced to zero. Incl. increase in financial leverage docile with a positive differential. With a negative differential, there is a decrease in the profitability of government capital.

Capital structure management

In Russia, the economy, which is rapidly developing, has few companies that can grow at a high pace and have large penny flows (butt - operators of a stylnikovy zv'yazku). The stench can independently raise capital investments, without going into the deep end of finance. Ale change the borg's ambition to lead to a weakening of the so-called disciplinary function of the borg. The very tractor serving the board, call the managers of the company to the best business solutions. Even though the investment is low, management is reducing incentives to the point of being the most efficient investment opportunity.

The main reason for the long-term financial success of a company is the profitability of capital (assets) can be greater than the profitability of capital. Why is it obvious that in low-profitable types of business, mothers have a lot of power funds (unruly bridges, transport is poor) is not visible, therefore, the degree of lucrative income for such an active capital is completely overestimated in terms of income from them, leading the company to an economic and financial minus. Not only unprofitable, but also other companies should think about the possibility of outsourcing schemes for other business processes, and also do not forget the rule - bitcoin and non-core assets need to be dealt with in any way.

The scale of business in times is also important. Small businesses don’t want to talk about getting funds from the authorities. Great business is accepted as the norm, especially in the manufacturing sector. The middle business is located near the cordon region, and here it is decided to lay a deposit in the form of rent payments with a trivial term and an increase in the cost of income and the increase in power. At any time, for similar decisions, the financial service can work as accurately as possible and that the lining of the rozrahunki.

Risks support the business of all types and expansions. Forever dotrimuetsya direct staleness - what is the cost of the profit of the business, then the higher the cost of the risks, and that the lesser cost of the risk is ready to be accepted by the managers and the clerks, then the lesser cost of the income can be repaid.

The creation of reserves (accumulation of a single sum of assets in the form of a contribution from PIF, expensive metals, shares, deposits) is the main part of the financial and investment strategy. Without reserves, there will be a serious problem over the market and economics to put business between life. About tse, unfortunately, a lot of kerіvnikіv russian companies are forgotten, more and more rozpodіlyayuchi all taking profits for dividends and reinvestment (or investment in other projects). In this way, leading one or more viable activities (for example, stable and developing), companies that do not create reserves, increase risks both in the main business and in new projects.

In order to minimize financial risks, I recommend that the managers and the clerks of the companies after paying dividends to the shareholders create real reserves from the omitted river income from sufficient obligations. For whom it is necessary to grow exactly rozrahunki. The corridor of significance, which is most often taken, is 3-10% of assets fallowly in the form of a global equal to the risk of business. Then we can invest in the business, moreover, we can invest in the main (donor) one, increasing its stability and growth, and only a little later - in new projects.

For the management of reserves, you need competent fakhivtsі (for example, from valuable papers). If the company does not have any, then I recommend placing the preparation with PIF and bank deposits.

Capital- the main economic basis for the creation and development of business. In the process of its functioning, capital secures the interests of the state, the rulers of that staff. From the position of financial management, the capital of the enterprise characterizes the gross value of the capital in penny, tangible and intangible forms, investments in the formation of yogo assets.

Characteristics of capital:

Ø capital is the main factor of growth;

Ø capital characterizes the financial resources of the business, as a way to bring income. In its capacity, capital can act as isolated capital, which will bring income to the financial sphere;

Ø capital є the main dzherel molding dobrobutu yogo vlasnik;

Ø capital is the main leader of the market vartost of business;

the dynamics of the capital of the enterprise is the most important barometer of the efficiency of the government activity.

Fixed capital includes the main income, as well as unfinished pre-construction investments, intangible assets and new pre-construction financial investments (investments).

Dovgostrokovy іnаnsovі іninvestitsії є vytrati on the share of the fate of the statutory capital in other enterprises, on the receipt of shares and bonds on a dolgostrokovіy basis. Before financial investments, the following are considered:

Dovgostrokovі poses, seen by other undertakings under the borg goiter;

Varity of the lane, transferred from the debtor lease on the right to financial leasing (so with the right to purchase the transfer of power to the mine after the termination of the term of the lease).

working capital- Tse commodity-material stocks, debіtorska borgovanіst, koshti.

The main source of finance is the power capital. This warehouse includes statutory capital, capital savings (reserve and additional capital, accumulation fund, non-distributed income) and other income (finance finance, charitable donation and other)

The statutory capital is the sum of the funds of the founders for the provision of statutory activity.

Additional capital, as a result of the revaluation of the mine, as a result of the revaluation of the mine or the sale of shares for their nominal value

Dzherela molding of the power capital:

1. internal

Depreciation winding

Net surplus of business

Main revaluation fund

Other dzherela - income from the building for rent

2. call

Dodatkova issue of shares

Free financial assistance from the side of the state

Other dzherela - tangible and intangible assets that are transferred to FO and PL in order of goodwill.

Position capital- all bank loans and financial companies, positions, creditor debt, leasing, commercial papers and other. vin is subdivided into long-line (more than rock) and short-line (before rock).

Under the power of capital, there is a big amount of money to think about, which should be under the rights of power and victorious for the formation of assets. The number of assets, formed with additional investment from some government capital, is pure business assets. Power capital includes:

Statutory capital,

Reserve and additional capital,

Undivided surpluses,

Various financial funds created for business.

Indeed, the capital of the enterprise can be formed from the internal and external dzherel fin. resources.

The formation of the power capital of the enterprise, under the order of two main goals:

molding for the money of the power capital of the obligatory obligation of non-current assets;

Molding with the help of the power capital of the sole obligation of the turnaround assets.

Varity of undertaking- an analytical indicator, which is to establish an assessment of the profitability of a business with the improvement of all financial resources: borgo goiter, privileged shares, and some of the smaller shares of business.

Varity of undertaking =

Varity of all major promotions of the business (insurance for the market variant)

Vartist of borgo goiters'yazan (protected for the market vartistyu)

Variety of all privileged shares of the business (insurance for the market variant)

Costs and their equivalents

The cost of capital is the price, as the enterprise is crying for the yogo of education from the different gerels. Such an assessment of capital comes from the fact that capital has a lot of versatility, that it forms the level of operational and investment capital of the enterprise.

The first way is to designate the accounting (balance sheet) value of the government capital of the enterprise. Zgіdno z this way all the activation of the goiter is insured on the balance sheet for the variant of the income or the vindication. Vlasny capital is insured as a difference between the balance sheet assets and crops.

Another way - the way of the market vartost - is that the activation of that goiter is assessed for the market variant, for which the power capital is secured. This method more accurately determines the real level of protection of enterprises, gives the possibility of more dynamically and realistically assessing the quality of the government’s capital, the shards of the market, the quality of assets and the goitre, are constantly changing.

Medium value for capital SBK is an important indicator that characterizes the water rhubarb vitrate or the total sum of all vitrates, which blames the link from the lure and the capital:

de Di - pet vaga skin dzherela u zagalniy sumi

Ki price of the i-th dzherel

Boundary vartist capital- between the efficiency of additional radiation to capital and the position of the average var. Vaughn characterizes the increase in var- tity of capital against the previous period. The boundary value of the capital is the tse rіchna vіdsotkovy rate, as it is necessary for the greater capital one penny unit:

de PSK - borderline varty to capital;

∆SCK - increase in the average value of the capital;

∆K - increase in total capital.

Capital structure- investment of shares, bonds, assets, including the capital of the business, otherwise seeming, investment of power and positional assets. Category, scho vіdbivaє vpliv tsgogo chinnik on the amount of net surpluses, є fin. important. Tsya zalezhnistnost polagaє in that postulate, scho vartist to kapital to deposit z yogo structure.

Capital structure management- the process of determining the balance of power and position capital, which ensures optimal proportions between equal profitability of public capital and equal financial stability, tobto. maximizing market variability of business.

Capital structure models

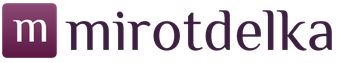

Traditional model transferring that the optimal structure of the capital is known, and in the form of it, to deposit the capital. The price of capital to lie in the price of warehouses: wet and low capital. When the structure of capital is changed, the varity of the tsikh dzherel is changed. A small increase in the share of the position capital to the implicit bond of the necks does not directly add to the change in the price of the power of the necks. With increasing parts of the positional capital, the variability of the power capital begins to increase at an increasing pace, and the variability of the positional capital becomes permanently fixed, which begins to increase. The price of position capital is much lower than the price of government capital, if the structure of capital is optimal (30% -50% of the share of position capital), the average value of the price of capital may be the minimum value, but the price of business will be maximum.

Model Modilyani – Miller presenting an analysis of two firms: L- a firm that has victorious positional capital and is financially indebted, that U- a financially independent company, as it does not attach a positional position. In the process of developing their own model, F. Modilian and M. Miller allowed the presence of effective and thorough markets (a number of commission brokers, however, a hundred rates for all investors, free and available information for all partners, dilimists).

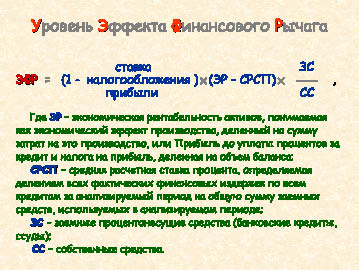

The degree of entrepreneurship, which is the value of the position capital, the cost of the capital of a financially independent company (which is not the value of the position capital) and the effect of financial leverage (important):

Vl = Vu + EFR

![]()

De: EDF - the effect of financial importance

Tpr - tax rate

EP - economic profitability of business

SRSP - average rozrahunkovy rate vіdsotka

ZS - positional koshti

SS - wet bones

EBIT- net operating income (before payment of additional bills and taxes)

Ksu - the need for equity capital

With increasing parts of the position capital, the effect of financial value increases. You can get Koshti doti, doki EP > SRSP

The main shortcoming of the model is the lack of greater theoretical allowance for the real situation that is developing on the market. Do not be afraid of brokerage witrati, witrati, pov'yazanі z financial scrutiny, agency witrati, real market market.

Compromise model - damage to the shortcomings of the front models:

de PVf– the variability of scoring of vitrates, tied with financial

difficulties

PVa- varity of scoring vitrates, tied with agency

Vіdnosinami

T - rate of tax on profits of business

D – market price of position capital

Vitrati, pov'yazanі z financial twist є dodatkovі vitrati pripriєmstva, scho zdіysnyuyutsya in case of the threat of bankruptcy. The stench is seen in direct and indirect bankruptcies. Straight Vityatti Bankruptcy є Venteti Vnaslіdda Psuvanna Main, Paying Roveh Sloat, ADMINSІNSTATIVITIES WITTAT TA IN TO PERMINE WITTOW WITTOWS VITRATURE ON THE RESPECTED OF SPECIAL DISTRICT RISTERS, VITAZY, VITAZYAZA BY FINANCE PROTECTORS, WITTROY, TAKABARY Z DII SPOZHIVA, ONEMIVA MATERIVA. The prices of glassware are large and sometimes reach up to 20% of the company's vartage. In this way, financial difficulties increase the price of the company's capital for the increase in the capital gains of shareholder capital and change the company's variance.

Agents' vitraty є vitraty for the company's security management and control over its effectiveness. At the cost of increasing the price of position capital and changing the price of equity capital, which reduces the efficiency of position capital gains.

Compromise model of capital structure

The price of the capital of the subject of the state is rich in what to deposit in this structure.

The structure of the capital of business (Fig. 55) - tse spіvvіdnoshnja mіzh dzherelami kapitalu (vlasnymi and pozikovym kapitalom), scho win for the financing of yoga activities. Some short-line positions are included from capital, so that they signify the structure of capital as a capital stock, which is chosen for long-term financing of investment activities of business. At the same time, as short-term positions are set on a permanent basis (what the majority of the capital falls and falls), in our opinion, we should include the stock of capital when analyzing the structure of finance.

Rice. 55. Basic designation of the capital structure of business

The optimal structure of capital is the same as the increase of borgo's goiter and the power of capital, which maximizes the total potential of the company.

If it is necessary to supply the optimal structure of the capital with the position of the output variance of the financial resources, then it is necessary to ensure that the borgo goiter is cheaper, lower shares. Otzhe, vartist of positional capital in the middle lower, lower vartist of power capital. It is obvious that the replacement of shares with cheap position capital changes the average value of the capital, which leads to a higher efficiency under the responsibility and, later, to maximize the value of business. Therefore, a number of theories of financial management will be put to good use, that the optimal structure of capital is transferred to the best possible position capital.

But in practical activities, it appears that the replacement of shares with cheap position capital reduces the company's market share, as it is considered to be the market share price of the company's own capital.

In addition, the growth of the borg increases the risk of bankruptcy, which can be littered with the price, if the potential investors are willing to pay for simple shares of the firm.

From the point of view of positional capital, there are also important non-financial vitrati as the legacy of the exchange of freedom for managers in the fields of position. You can either use the goal of creating additional reserve funds for redemption of the debt, or else you will be able to get rid of the blind dividends, which will undoubtedly reduce the business’s volatility.

That is why it is impossible to change the formula for assigning the optimal structure to the capital of a particular enterprise. The manager, however, although the structure of the capital of the company is close to optimal, is obliged by the singing world to rely on intuition, as in his line he will be on the information that is safe both internally and macroeconomically.

In addition, the acquisition of financial resources from various sources may be organizational and legal, macroeconomic and investment facilities.

Before the exchange of the organizational and legal nature, one can see the legislature fixing the law to the extent that the formation of four elements of the power and position capital, as well as control over the management of the company from the side of the Vlasniks.

The macroeconomic environment includes the investment climate in the country, the country's risk, the emissial credit policy of the state, inflatable system podatkuvannya, the value of the rate of refinancing CPU, inflation rate.

Obsyazh financial resources, as a company can get from different sources, and the term, for which stench can be obtained to a business turnover, to accumulate as a difference between the financial and credit markets, as well as the availability of these funds for a particular enterprise. One of the most important environments for the formation of the financial structure of capital is the dependence of the sphere and the nature of the activity of the enterprise on the part of the shareholders and/or the steps of the creditors.

In this way, the same theory cannot provide a comprehensive approach to the solution of the problem of the optimal structure of the capital of the business. Therefore, the practical formation of an economically rational structure of capital is carried out with the improvement of one of the advancing principles:

1. The principle of maximization of the level of the predicted profitability of capital.

2. The principle of minimization of capital cost.

3. The principle of minimization of financial risks.

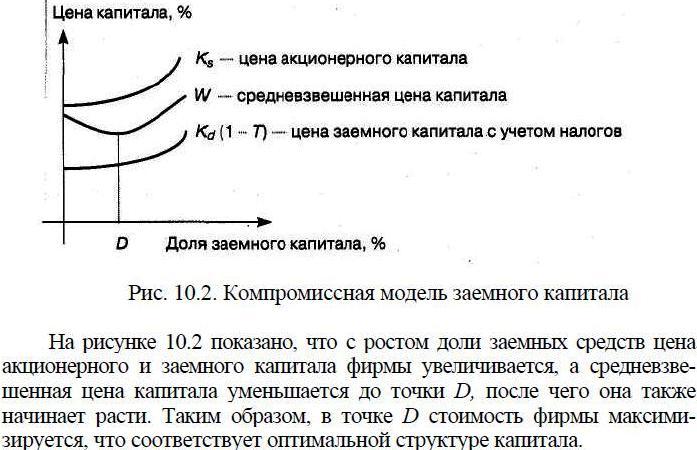

At the same time, the value of financial instruments is low, for the help of which it is possible to increase the efficiency of managing the financial structure of the capital of business. Among them - a variety of financial factors, for the help of which you can evaluate the process of changing the financial structure of capital at the financial site of business and that stage of protection of the interests of creditors and investors. Let's talk about ostentatious things that characterize the financial stability of the business and the efficiency of investments after it (Fig. 56).

Rice. 56. The concept of financial stability of the subject of government

that formula for the calculation of the coefficient of financial stability

Identified Final Histios, Izkosti PІDPRIEMYSTVIA Із Із Стартный прибуек і і иманим кизика Вимагає безенняннянна підприствиствичності коловінованості и и и и и колідать польтаться куловное волосто волото in Temі 6), І-creditospome, yak not є synionm.

Under the credit promotion of the undertaking, there is a new reconsideration for the withdrawal of the loan from that first term. The borrower's creditworthiness is characterized by his diligence in case of early repayment of loans, the current financial situation and the ability to mobilize money from different gerels for the need.

The coefficient of financial stability characterizes the financial stability of the power and position of the bank. If this ostentatious show is more than alone (є the transfer of wet cats over the poor ones), it means that the enterprise can have a sufficient supply of financial stability.

p align="justify"> Coefficient of financial dependency (Fig. 57) characterizes the dependency of business in foreign positions and shows that a part of the company's lane is paid for the account of relative positions. The higher the given coefficient, the more risky the situation is with financial stability and the greater the likelihood of the deficit of funds.

Rice. 57. Formulas for the calculation of the coefficients of financial dependency, security with wet cats and self-financing

The coefficient of security with wet money characterizes the building of business to ensure the need for financing of working capital only for the money of wet dzherel. Financial camp enterprises are considered to be more important, because this show is more expensive, or more than 0.1.

The coefficient of self-financing shows that a part of the investment can be covered for the money of the internal resources of the enterprise - unspread income and accumulated depreciation. It is low for the authors to consider the sum of the undistributed surplus and depreciation as a pure penny potik, or a penny potik in the face of the government's activity of business. Todi coefficient of self-financing can be called "an indication of a penny investment". What a display, then more money for self-financing business, then more financial stability.

The coefficient of autonomy (concentration of power capital) characterizes a part of power capital of the financial structure of capital (Fig. 58). For greater financial stability, it is necessary to have a balance of 0.5-0.6.

Rice. 58. The formula for the calculation of the coefficient of autonomy (concentration of power capital)

A number of authors add a coefficient of autonomy to the point of showing liquidity, what we can do with the logical, shards of prosperity for our goiters, we can help us with the help of our own dzherel. At one time this indicator is an important factor in assessing the financial structure of the enterprise.

In order to ensure the overall financial stability of the business management, in order to secure sufficient payment producibility and credit producibility of the goiter, to increase the liquidity balance, and the financial structure of the capital is due to:

The creditor's fence is not guilty of overestimating the value of the largest liquid assets of the enterprise (they can be seen in the first line of money and short-line papers);

Short-term loans and positions and part of long-term loans, the terms of repayment of which fall on the given period, are not responsible for overestimating the amount of liquid core-realized assets (debt-borrowing, fees on deposits);

Long-term credits and positions are not guilty of overestimating the value of fully realized current assets (stocks of finished products, syrovini and materials);

Vlasnі koshti owe buti for the amount of non-negotiable assets of the enterprise.

Looking at the financial structure of the capital of the business, it is necessary to analyze that building and service the constant payments - the payments for the position capital and the dividends to the shareholders of the share capital. For such an assessment, there are indications of market activity, or the effectiveness of investments.

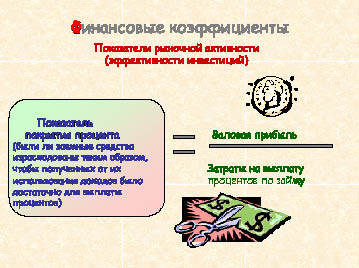

Coefficient of credit coverage (Fig. 59) characterizes the level of protection of creditors in the case of non-payment of credits for granting a loan. Wook an accurate emptic rule of the optimal meaning of Krayfіtsієntіv Preestty VіdSotkіv І Divіdddіv not ІСНє, Bіlshіtiytikіv go to Dumzі, Shah Mіnіmalna Valida Kyufіrttsієnta Maj Buti Rіvimnaya 3. The zinage of the Central Decorator is to breathe about the fucked fiscal rhizika.

Rice. 59. Formula

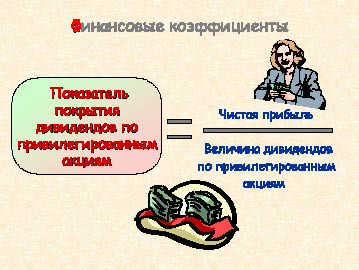

For an additional coefficient of coverage of dividends for preferred shares (Fig. 60), it is possible to evaluate the company's property and service the collection of dividends in front of the holders of preferred shares. In this way, the calculation of the formula is the value of the net surplus, because dividends are paid less from the sum of surpluses after podatkuvannya. It is obvious that the closer is the show to one, the better is the company's financial position.

Rice. 60. Formula for the distribution of dividends for preferred shares

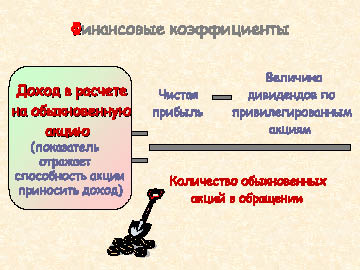

Income from a retailer for a special share (Fig. 61) is the main indicator of the market activity of the enterprise. Vіn characterizes the building stock to bring income. Vychayatsya net profit, changed by the amount of dividends for preferred shares, to the company's largest shares.

Dividend coverage ratio (Fig. 62) estimates the amount of cash inflows that can be used to pay dividends for outstanding shares. The return to this coefficient is a show - the coefficient of dividend payout, which increases the sum of the accrued dividend to the income of one significant share and shows, as a part of the net profit the company directs to the payment of dividends.

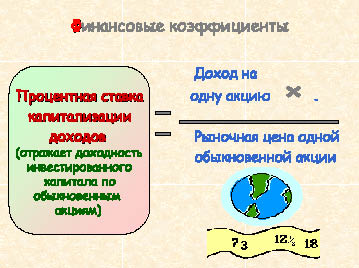

The interest rate of capitalization of income (Fig. 63) reflects the profitability of invested capital and the rate of equity capital for outstanding shares. The financial essence of this show is that it can be seen as a rate, for which the market capitalizes the sum of current income.

Rice. 61. formula

Rice. 62. Formula rozrahunku koefіtsієnta pokrittya divіdendіv for zvichaynimi aktsіyamiOtsіnyuyuchi fіnansovu structure kapіtalu kompanії, slіd vrahovuvati scho not іsnuє іdealnih koefіtsієntіv, SSMSC in stanі vіdobraziti all rіznomanіttya gospodarskoї dіyalnostі pіdpriєmstva, yak i do not іsnuє yakihos bezumovnih pokaznikіv Yakimov potrіbno pragnuti for whether yakih obstavin .

So, we have seen that for the financial stability of the enterprise, a high part of the government capital is necessary. At the same time, as a company, the posture of a sufficient world vikoristovu pozikovі koshti and intermingling vikoristannyam vladnogo kapital, tse can lead to an increase in development, a fall in competitiveness, physical and moral obscenity, inadequacy of the characteristics of the finished product. It is all about reducing the gross profit, hence, the profit per share, the reduction in the market share price and, as a result, the decrease in the company's market share. At one time, above the height of the temple of the vaga pozikovyh koshtіv at the pasivah, to note about the advancement of the risk of bankruptcy. In addition, the rulers of credit funds can establish control over the firm, as far as possible obmezhenoy mozhlivistyu self-financing.

Rice. 63. Rosrahunka Formula interest rate capitalization of income

In most cases, financial factors are only a hint of what is going on in the business, how to change those trends, how to stink into business development. Financial indicators help to take care of the most important food, connected with the current and strategic activities of business, such as:

-Which is more important to each stage of business activity - high profitability or high liquidity?

-What is the optimal value of the necessary undertaking of a short-term loan?

-What part of the pributka rose like a dividend?

- Carry out a new issue of shares to get the position capital? etc.

Zreshtoy, after praising any decision related to the management of the financial structure of capital, next to remember one of the main goals of financial management - maximizing the profit of the company.

To add to the profitability of business, you can change the way you oblige and the structure of liabilities.

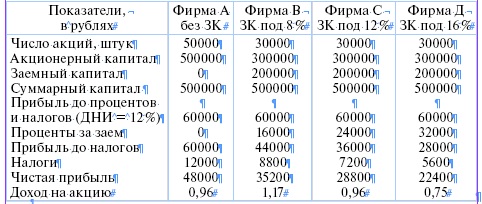

Let's take a look at the butt showing the activity of some firms, however, they are the same for all, Crimea, the size and the rank of the position capital.

Also, the firm Anne vikoristovau position capital, the firm Vimey position pid 8%, the firm C-pid 12%, the firm D - pid 16%. Income on investments (inflow of invested capital) of leather firms to become 12%. The nominal value of shares is 10 rubles, the surplus contribution is 20%.

Irrespective of those that all firms may have the same debt and investment income, the firm will secure its shareholders more income per share, lower firm A, which does not win the position capital. Earnings on shares firm Аї W, try different structure of capital, however. The smallest income on shares is taken away by the shareholders of the company D. The result of deliberations is taken away by two reasons:

1) so that the income for a loan is deducted from income, as a rule, before the taxation of taxes, the financing for the salary of the positional capital reduces the contribution of income and deprives a large sum of income from the company's shareholders;

2) the company can, with an effective victorious position capital of the mother, additional income, which after paying hundreds of dollars to investors can be divided between shareholders.

For whom the value of income on capital investments (DNI) may be higher for interest, as the firm pays for the remaining position capital.

So, firm B, paying for the position of 8%, secures the profit margin of 12%, which increases the profitability of shares equal to that of firm A. In this case, there is a positive effect of financial value (Fig. 64). Ufirmi Rivne DNI spivpaє scene pozikovogo capital, that income per share more than earnings per share of firm A. The effect of financial value is zero. Firm D, paying for the position of 16% and 12% for the day, equals 12%, it is succumbing to the negative effect of financial importance.

Rice. 64. Concept of financial importance

It can be seen from the formula for the cost of income equal to the effect of financial value (Fig. 65) that the positive, negative value of the zero value of the effect of financial value lies in the difference between the economic profitability of assets (ER) and the average value of the cost of income (SRSP) (the so-called differential value). If ER>SRSP, then the differential, and the effect of the financial value is positive; Yakscho EP< СРСП - отрицательный; если ЭР = СРСП - нулевой.

The value of the effect of the financial value is also due to the support of the positions and the power of the capital of the enterprise (the so-called shoulder of the financial value). If the value of the positional costs is higher than the value of the power capital, the power of the financial value will increase, if lower - it will fall.

Influencing the effect of financial value and the rate of subsidies, moreover, the lower one, the effect of financial value is more powerful.

When the optimal value of the positional capital is determined, as you can get financed by your own government activities, it is necessary to ensure that the structure of the capital lies as a profit, and a financial risk.

In times of financial risk, it is taken as an observation of the actual result as planned.

Rice. 65. Formula rozrahunku equal to the effect of financial value

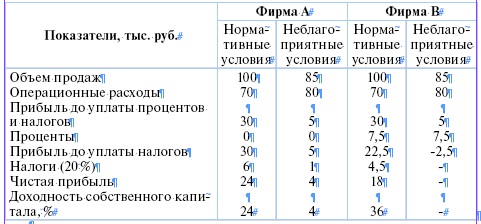

Ilustration of the injection of positional capital on the risk and the profitability of the undertaking of activity can be an offensive butt. Firms Ai Vmіyut teh same assets (100 thousand rubles), Obsyag sales (100 thousand rubles) І operating costs (70 thousand rubles). The cost is only the structure of the capital - the company Affirms only for the salary of the power capital (100 thousand rubles), the Firm V-for the money of the moisture (50 thousand rubles) and the first position (50 thousand rubles. Pid 15%) to the capital.

In this way, for normal minds, the company will secure income for its shareholders on shares in the world, so for the second time I will transfer income on the shares of company A. that she recognized the influx of financial importance, in the fall especially sharply, blame the beat. Firm A, in the wake of a stable balance sheet, can more easily endure the decline in production.

It is evident that firms with a low frequent intake of less risky, and ale stink allow for the possibility of a positive effect of financial importance of increasing the profitability of government capital. Firms with a high share of the position capital can be mothers of a higher income of the state capital, if they are economically smart, but they are subject to the risk of inflows, as they appeared in the minds of the recession, or the financial losses of the managers of the firms are not right. When it is necessary to insure that, as if only a small part of the deposit is made by the Vlasniks, then the risks of admission are mainly borne by the creditors.

In summary, it is significant that the structure of the capital of business is responsible for ensuring the most efficient performance between indicators of profitability and financial stability. In order to achieve the goals of one of the most complex tasks of financial management, the process of optimizing the structure of the capital of the subject of the state government is guilty of including a few steps:

1.Analysis of capital with the method of revealing trends in dynamics will cover the stock of capital and their contribution to the efficiency of the capital and the financial stability of the company.

2.Estimation of the main officials who inject the structure of capital.

3.Optimization of the structure of capital according to the criterion of maximizing the profitability of government capital by one-hour assessment of the spread of financial risk and the effect of financial importance.

4. Optimization of the structure of the capital according to the criterion of minimization of the varity, for which the price of the skin element of the capital is determined and the insurance of the average vartity is based on the rich variant rosrachunkiv.

5.Differentiation of financial risks according to the criterion of minimization of the level of financial risks.

6. Formation of the target structure of capital, which is the most profitable and the least risky.

If so, you can work out the work from the obtained financial resources and other sources.

RIGHT

10.1. On the basis of the data of the company's accounting rate, given in task 6.1, determine indicators of the financial stability and market activity of the company.

10.2. Appreciate the effect of financial value, as follows:

Viruchka per implementation - 1 million 500 thousand. rub.

Replacement windows - 1 million 050 thousand rub.

Postiyni vitrati - 300 thousand. rub.

Dovgostrokovі credits - 150 thousand. rub.

Short-term loans - 60 thousand. rub.

Average rozrahunkovy rate vіdsotka - 25%

Vlasni koshti - 600 thousand. rub.

Rumovna rate of subsidy surplus - 1/5

10.3. Know the value of the effect of financial value, such as:

Sales - 230,000 units for a sale price of 17 rubles per unit,

Fixed stained glass - 310,000 rubles,

Changing bills per person - 12 rubles,

Congestion - 420,000 rubles pіd 11% rіchnyh in the average,

Share capital - 25,000 outstanding shares at a price of 60 rubles per share.

What is a friendly financial important and why? Let's assume that another company can have the same number of shares, days, amount of assets, like a company, and can't be the same. How can a firm have a larger earnings per share?

10.4. Appreciate the effect of financial value, as follows:

Sales volume - 9.25 million rubles.

Operational vitrati - 8.5 million rubles

Congestion - 6 million rubles. pіd 15% rіchnyh.

Share capital - 7.2 million rubles.

The rate of subsidy to the profit is 24%.

What is a friendly financial important? With such a price of positional capital, the strength of the injection of the effect of financial value is equal to zero?

10.5. Mini-case "Financial alternatives"

Friday, 15:00. Vladislav Mamlєєv finished his short call at the office of the investment firm "IVNV". Stanislav Burobin, a partner of the firm, is currently working with the contractor. Vіn traveled around the region, in view of the potential clients of firms and advocated to invest in their vail funds for additional assistance IVNV. By midday I phoned and told Vladislav's secretaries that I had sent my recommendations by fax by Friday. Shoino's secretary brought the fax. A new one may have a recommendation for a deposit at the price of paper for three clients of the firm. Vladislav can call on these clients and request them to be swept away.

Faxed text: Vladislav Mamlev. IVNV. I was urged to go licking for the weekend. I'll be back in the middle.

My recommendations: (1) simple shares; (2) preference shares; (3) bonds with a warrant; (4) convertible bonds; (5) debenturi advice. Stas.

Vladislav knows the hearing aid to call the clients. I raptly fall into the thought that the propositions do not meet the investment needs of the client. Vіn know schafі dosє dermal z zіh trоkh kієntіv. Before them, short contributions were made, folded by Stanislav. Vіn chitaє tsі dovidki:

Firm "MTV". You will need 8 million rubles at a time and 4 million each at the foot of the chotiri rocky. A packing company that is growing rapidly in three regions. Simple shares are sold through brokerage offices. Shares of firms are underestimated, but may rise in the next 18 months. Ready to issue valuable papers, no matter what type. Gary management. Get clearer growing up. New machines may be able to improve the supply. Recently repaid the borg at 7 million rubles. There are no borgivs, krim of short-lined ones.

Firm "Stroganovski Zavodi". You will need 15 million rubles. Old management. Promotions are inexpensive, but there is an increase in prices. Vіdminniy prognosis for the growth and growth of the advancing fate. The low ratio of positional cats to capital, the company tries to buy the Borg to maturity. Utrimuє most of the surplus, crying big dividends. Kerіvnitstvo does not want to allow outsiders to control that right to vote. Pennies are needed for the purchase of equipment from the selection of plumbing equipment.

Firm "Brother Demidov". You will need 25 million rubles for the expansion of furniture manufacturing. The company started as a family business, and now it has 1300 employees, 45 million in sales and sells its shares through brokerage houses. Look for new shareholders, but don't want to sell your shares cheaply. Directly positional trochitis is more than 10 million rubles. Kind management. Garni prospects for growth. Good luck. Guilty to save the interest of investors. The bank is willing to lend a short-term loan to the company.

Having read the statements, Vladislav asked Stanislav's secretary, so that he did not leave that kind of material for these companies. Reply: “Without leaving, but today, calling and asking for confirmation that the information given to the client is reliable and it is especially distorted by him.”

Vladislav obmirkuvav situation. It is possible, obviously, to make a decision for the coming day. And just two more years of this year, and just think about it, it’s enough for an hour to work out the exact proposition: like a price of paper and recommend to the skin client specifically OKremo. Virіsheno: warehouse more argumentative propositions and over the phone to clients, as they said, today.

Nutrition (for work in small groups): What is the best profile of finance for a skin client?

CONTROL TESTS

1.Structure of capital - tse:

1) support between different capitals

2) setting up borgo's goiter to the sum of assets

3) spіvvіdshennya vartosti simple and privileged shares of business

2. Equal to the effect of financial value:

1) start positive

2) start the negative

3) can be both positive and negative

4) set the value to zero

3. Specify the standard for the coefficient of safety with wet cats:

1) ≥ 1,0

2) ≥ 0,1

3) ≥ 0,5

4. If the value of the positional costs becomes higher than the value of the power capital of the business, the strength of the investment of financial value:

1) grow up

2) falling

3) is left without change

5.Differential of financial value - tse:

1) the difference between the salary and position capital of the enterprise

2) the difference between the economic profitability of assets and the average retail rate

3) difference between deducted incomes and expenses incurred during the summer period

6. Financial stability of the enterprise:

1) to deposit in the form of financial support and financial support

2) to deposit in the price of the position of the dzherel finance

3) to deposit in the form of capital investment

7. For the appointment of a part of the power capital in the financial structure of the capital, the indicator is awarded:

1) finance coefficient

2) coefficient of financial stability

3) coefficient of maneuverability

4) autonomy coefficient

8. To assess the ability to serve a few hundred for the position capital, serve:

1) indicators of market activity

2) indicators of business activity

3) indicators of financial activity

The structure of capital is the necessary reduction in the rate of turnover, increase in investment, and increase the turnover of capital, which in the result leads to an increase in income in business. The optimal structure of capital allows for the best possible realization of its potentialities.

Structuring the capital of the industrial business allows you to carry out as an example, and a calculus assessment of the capital, and to characterize the effectiveness of the first century. Analysis of the capital of entrepreneurship is the most important stage in the process of making the capital successful.

You can structure the capital as the balance sheet items on the date and evaluate your liquidity.

The balance sheet is presented as a list of assets and liabilities of the business, in which the main and working capital is shown, or, according to Russian terminology, the main and working capital funds.

Fixed capital- part of the productive capital, like a stretch of a trivial term, victorious in the workmanship and transferring its versatility to the finished product step by step, the world is worn out. working capital- part of the productive capital, which is transferred to the creations of the product and turns in a penny form by stretching one circle.

The selection of old, worn funds significantly reduces the active part of the production capital. At that very hour, a part of the main capital is passively growing, shards of growth are the variety of capital houses - budive, sporud is thin. Dosit low showings that characterize the age structure of fixed assets. Significantly, the problem of replacing the old property has become more acute, the most important problems have been the machinery and equipment, transmission outbuildings, and transport facilities.

Before undertaking, it is necessary to put in place a more advanced task of improving the capital structure as a basis for the development of manufacturing. Classifying warehouse chains of the structure behind the moldings, we can see three main components: the power capital, the position and the radiation. Optimization of the creative structure to allow enterprises to improve their financial position (financial stability), to secure the respect of potential investors.

In today's minds, the task of optimizing the creative structure is to set few problems for the enterprise. Nasampered, this is the problem of victorious capitals of subsistence (power capital), the molding of which is necessary for us to come from the surplus and depreciation windings.

We also see the variant structure of the capital of the enterprise, which determines the capital stock and turnover capital. The designated proportions of the spivvіdnennia between them in the modern minds of the world of the world lie in the form of a creative structure, which signifies the mobilization of the power and position of the koshtіv, dzherel їх molding.

It is necessary to note that the capital of business has a subordinate nature, that it sounds like an active and a passive part of the balance of business. The analysis of the active part of the capital's conversion allows us to draw conclusions about the first and last changes, to determine the liquidity of the capital, to characterize the real process of change or the increase in capital. For example, the camp of the main capital of the business will be the basis for making a decision about further investment (capital investment) of the business, the analysis of the working capital allows you to show the reserve of reducing the cost of production and to add to the investment process.

But looking at only the active part of the capital does not allow to carry out an exact analysis, it is necessary to look at the structure of the capital, which is presented in the passive part of the balance sheet (passive capital), as if it were a process of forming the payment of the mine and the crop (financial capital).

Financial capital can also be divided into great groups - high-ranking and educated, or positional capital (div. Fig. 2).

Spivvіdshenie mizh vlasnymi and pozikovymi koshta - one of the most important financial indicators of the work of business. The importance of this indicator is influenced by the choice of the economic policy of entrepreneurship in the case of victories of various incomes, either by the authorities or by the best, which is especially important for the process of expanded capitalization of the entrepreneurship.

In general, characterizing the structure of capital of business, it is necessary to ensure that active (functional operating) capital and passive (financial) capital are two mutually related components presented in the diagram (Fig. 9.2).

Oskіlki the main organizational and legal form of business ventures are joint-stock partnerships, we can look at the structure of joint-stock capital in the same way to the principles of its formation. When consecrating the partnership of leather, the founder will deduct the number of shares, proportionate contributions made, as a win can claim the hour of carrying out the liquidation calls. Henceforth, the share capital is made up of okremih elements - shares and, it can be said, it is like a fence of partnership to shareholders.

Vіdpovіdno to the Law of the Russian Federation "On joint-stock partnerships" it is allowed to carry out structurization of joint-stock capital. Up to 25% can become preferred shares, reshta - simple shares.

Shareholder capital has an eminent nature, blaming the issue of the sale of valuable papers of the partnership. Payment can be charged as a penny, and in other ways. Therefore, the formation of assets is stale in the form of payment. Having seen the stock of equity capital, it is also necessary to work out your market assessment. And here comes the real structured market assessment.

Additional capital is the hemision income from the placement of shares and reserves, withdrawn in case of revaluation of the main assets. Ninі tsya skladova yaky zavzhdi vіdbivaє realnі dzherela vlasni koshti pridpriєmstv. So, the re-evaluation is based on the variation of the same coefficients, which may or may not be consistent with the real market indicators.

Shares, bonds and other valuable papers are fictitious capital, the stinks of stench are less likely to reflect the variability of real capital, which is behind the manufacturing process, but the manufacturing process itself does not function. Tsya two hundred nature of the capital of a joint-stock partnership can be invested heavily in the development of entrepreneurship. For example, a decrease in the market value of shares in the market of valuable papers can cause an increase in financial resources of the business due to the fact that the contributions of shareholders (founders) are increased, and the changes in investments are also reduced. Entrepreneurship can be in the minds, if the actual real capital, which may have a high degree of versatility and virobnicheskoy potential, be significant and not be able to function normally. This situation developed in the wake of the financial crisis in 1998.

It is necessary to protect the organic life capital. Tekhnіchna budova kapitalu є vіdshenie mіzh mіzh zastosovuvanih zasosovuvanih zasobіv vyrobnitstvа і kіlkіstyu pratsі, nebhіdnoyu їkh zasosuvannya. Varta budova є vіdnosnja vartosti zasobіv vrobnitstva (permanent capital - Z) to vartosti labor force (variable capital - V). The growth of organic life shows capital that the interrelationship of technical and variant yoga is connected with the development of scientific and technical progress. Today, under the working force, tobto. change capital - human capital is considered, and changes in this structure are also marked by the development of scientific and technical progress. Currently established, technologies require a high level of qualification, certification, enlightenment, tobto. to bring the official work force into a new level of development.

9.2. The structure of the capital of the enterprise

An important role is also played by the presence of assets in the acquisition of intangible assets. "Intangible" capital does not appear in financial documents, does not have a valuation, but takes part in the process of taking profits and bringing it yourself. Most of this capital is the basis of the organization of production. Up to the new one to bring: pіdpriєmnitski (dіlovі) ideї; channels for rozpodіlu viroblennyh varіv (channels zbutu); business calls; using the singing secrets of manufacturing (technologies, technical solutions, solutions in the field of design only); Volodinnya exclusive information of economic and business nature. Everything for the singing minds іstotno vplyvaє on the size of the surplus and the rise of the development.

Intangible assets are subdivided into sprats of great groups:

1) the right to power (koristuvannya land, natural resources only);

2) intellectual power - the result of rozumova practice, "know-how", author's certificates, patents, licenses, and other ideas;

3) organizational and commercial vitrati, connected with the establishment of a legal entity.

The main reason for the current economy is the search for optimal balance between tangible and intangible business assets. Depending on the combination of these two factors, the results of all state activities of the enterprise, its competitiveness and profitability, the organization of work, and innovation activity will lie. Vikoristannya primed commercial roses, as they allow the reception to take a high income, and to secure the possibility of a farther extended opening.